Capital Raising Advisory

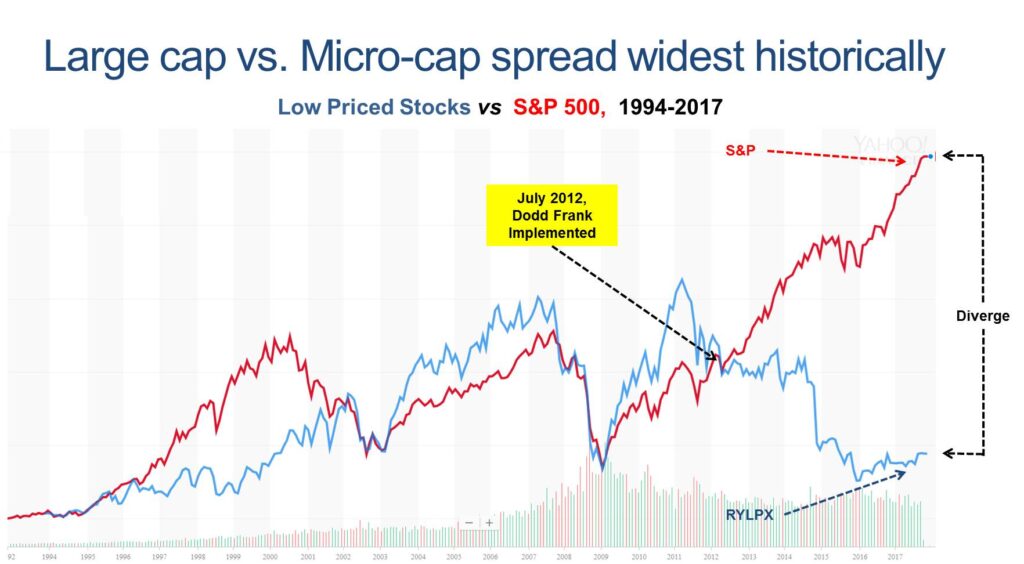

In the post-Dodd-Frank world, capital raising is incredibly challenging. Woessner Advisory is here to help. For smaller-cap companies, capital raising is more difficult than before.

Startups in America are STARVING for capital. This is particularly true for startups lead by female entrepreneurs and minorities. The statistics are staggering as you can see here.

Woessner Advisory mentors your startup or emerging growth company and assists you in capital raising. We specialize in a variety of capital raising strategies including Equity Crowdfunding.

What Is Equity Crowdfunding?

Equity Crowdfunding lets startups and private businesses raise capital from the “crowd.” Everyone can be an investor, not just venture capitalists and private equity firms.

You raise money from the “crowd,” including friends and family and investors you find through social media solicitations.

Your investors do NOT have to be accredited investors.

You can raise money from ordinary people, so called “Main Street” investors. You do not need to know venture capital firms in Silicon Valley or Wall Street investors in New York to raise money. You are raising money from ordinary Americans.

How Does It Work?

Getting started is straightforward. Success taks a lot of expertise, planning, and promotion.

The basic path is:

- Register your company with an SEC registered investment portal

- Create a campaign in the portal

- Ensure your financials, marketing, and action plans are compliant

- Advertise and promote your crowdfunding campaign

Woessner Advisory is here to help you every step of the way.

How Much Can I Raise?

You can raise up to $5,000,000 annually. Moreover, you can raise up to $250,000 with only a certification from your Company’s CEO instead of financial statements reviewed by an independent public accountant. After that, you can raise up to the $5,000,000 with only having your accounting firm review your financial statements. In some cases, no audit may be required.

You control the terms of your funding round: no board seats, no term sheets, no negotiations with investors; no giving up control of your business. YOU control the terms of the funding not the investors.

How Much Will It Cost Me To Crowfund?

Your upfront costs to the SEC registered portal are usually ZERO. The portals typically only get paid if you are successful.